The CPF Group has posted strong financial results for the year ended 2024, driven by robust asset growth and rising membership across its pension schemes.

The LAPTRUST Defined Benefit (DB) Scheme saw net assets rise to Sh28.1 billion, up from Sh26.99 billion in 2023, reflecting the scheme’s consistent investment strategy.

The County Pension Fund (CPF) posted the most significant growth, with net assets surging to Sh51.67 billion from Sh36.97 billion.

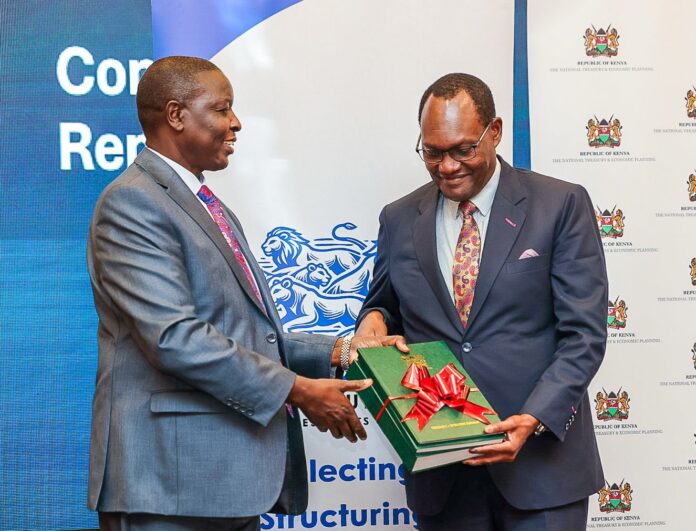

CPF Group Group MD and CEO Hosea Kili credited the performance to prudent fund management, a deep understanding of member needs, and a focus on financial literacy through innovation and partnerships.

The Group declared an 8.8 percent interest rate despite macroeconomic volatility.

Active membership rose to 94,116 following the enrolment of over 17,500 new members, while the sponsor base expanded to 194 institutions.

Other schemes under the Group also recorded positive growth, with the Salih Fund attracting 9,895 members, the Post-Retirement Medical Fund increasing its assets from Sh32.8 million to Sh55.2 million, and the Individual Pension Scheme posting a 42.4 percent rise in assets to Sh4.11 billion.