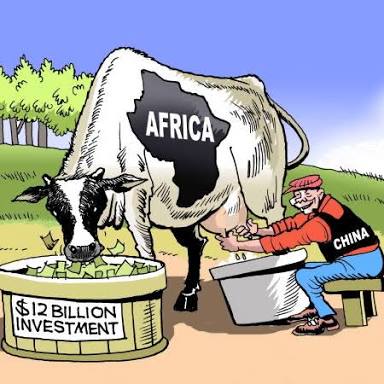

How a wolf in sheep’s clothing kidnapped Angola

Angola is a country in debt. At least $18 billion is being owed to Chinese

With projected debts of over $70 billion, about 70% of the national GDP, and an inflation rate of 24.75% as well as an unemployment level of 25%, the resource rich but heavily indebted Angola has decided to spend even more.

The country would be spending $198 million to modernize its national airline and hundreds of millions more to re-builde its central airport – thanks to tainted China’s CIF Sam Pa’s consortium.

It’s a story of mega corruption, total deceit and official recklessness.

Under the pretext of reforms, J Lourenco’s extravaganza has been overshadowed by Sonangol’s Chairman and his Economic advisor to the Presidency.

Flying Fictitious Facts

Sonangol Angola’s economic backbone, via an MoU announced the creation of a consortium with the purpose of seeing SonAir become profitable again.

In May 2018, Sonangol set up a consortium led by the Chairman Carlos Saturnino to privatize SonAir, its air carrier. It chose a familiar face, Daniel Sigaud, President of Heliconia (Luxembourg) who doubled as President of CHC (Canada).

Daniel and Carlos shared a past together as directors of GBI Consulting back when Carlos was in his initial Sonils Chairman of Operations. Sonils integrated logistics which was created between Intels then later Orlean Invest chairman Volpi and the Angolan state company Sonangol.

Other notable offshore leaks actors in GBI Consulting include Gian Angelo Perrucci. Somehow, Daniel was also a co-worker at Sonils and GBI Consulting. Daniel Sigaud brought in-depth knowledge of profitable setups for offshore companies in the Bahamas.

Since 1988, the two men have been majority shareholders and Directors of the London based consulting firm GBI Consulting (formerly DMS DEVELOPMENT & MANAGEMENT STRATEGIES LTD, FUTUREAIRO LIMITED), which has acted as the intermediary in many of Angola’s most profitable and controversial multinational deals involving Sonangol corruption ring.

Understood in the recent agreement, Heliconia and CHC have entered into a partnership with Sonangol to restructure SonAir. Carlos Saturnino, president of the Angolan oil company claimed the new partnership “should represent the beginning of the SonAir regeneration process.”

The MoU allows for a new consortium to be called T.A.A.G. SA.

It was part of many MoUs and agreements that will crescendo with extravagant spending following CIF’s confirmation of the construction of the new airport at a cost of $300 million by China International Fund which over the last few years has been strongly associated with Angolan $600 billion man Manuel Vicente.

But what does GBI Consulting have to do with Angola?

Today the major shareholder is Daniel Sigaud and N’Zogi Yetu Gestao de Empreendimentos Limitida, the latter having been involved in palm oil, waste management (Angola Environmental Serviços Limitada).

The Emperor’s New Clothes?

Facing renewed pressure as economic stagnation worsened, and currency devaluation, the desperate Lourenço sought assistance and urgent loans from the IMF to continue his privatization roll out while signing an agreement in May in Luanda for the purchase of Canadian Bombardier Q400s for an estimated $198 million. Suspiciously, Ana Dias Lourenco is also named on the documents LOI.

On 21 September 2018, a Presidential Decree declared Angola’s flag carrier TAAG would no longer be a state-owned company but a public limited company.

The Presidency issued a statement stating that the original national airline will be replaced by TAAG SA. The original logo and legal status remained unchanged.

The transformation of the national airline, from a public company will become a Public Private Partnership Sociedade Anónima (SA.)

According to the legal system of Angola, state-owned companies are exclusively owned by the state, while public limited companies are established under the Commercial Companies Act. The state can exert its influence directly or jointly by the state directly or through public institutions.

On October 6, 2018, shortly following his appointment as the Chairman of the Board for TAAG SA, Rui Carreira (formerly President of the National Institute of Civil Aviation), indicated a continuation of the previous policy and declared that “the biggest project of the Angolan flag company is to replace its fleet, with new acquisitions of airplanes for medium-haul flights …will no longer have the support of the State”.

Now, Angola is a country in debt. At least $18 billion is being owed to Chinese, and this past June 2018, Gemcorp arranged a financing of $150 million with the Government of Angola once again.

In all, a total of $1.7 billion is being owed to date and there is more.

At least $600 million (503 million euros) with the option of doubling up, to be used by credit agencies to export + 500 Million from German banks.