Absa Bank Kenya has reported a 15 percent rise in profit after tax (PAT) to Sh16.9 billion for the period ended September 30, 2025.

The lender, in its unaudited group results for the nine months to September, said the performance was driven by strong cost control and growth in non-interest income.

News

Winners of 2025 Africa Women Innovation and Entrepreneurship Forum (AWIEF) Awards Announced

Staff Writer -

The Africa Women Innovation and Entrepreneurship Forum (AWIEF) (www.AWIEForum.org) hosted a spectacular celebration of African women’s excellence at the2025 AWIEF Awards, held on Friday evening at the Cape Town South Africa.

The glittering gala honoured women entrepreneurs and leaders driving innovation, sustainability, and inclusive growth across the continent. Eight exceptional winners were announced, each...

News

HyDeal Ambition to Drive Green Hydrogen Dialogue as Strategic Partner at MSGBC Oil, Gas & Power 2025

Staff Writer -

Thierry Lepercq, Founder and President of HyDeal Ambition – a platform uniting 30 companies across the entire green hydrogen value chain – will speak at the MSGBC Oil, Gas & Power 2025 conference and exhibition, taking place from December 8–10 in Dakar, where the company will also participate as a Strategic Partner.

Building on...

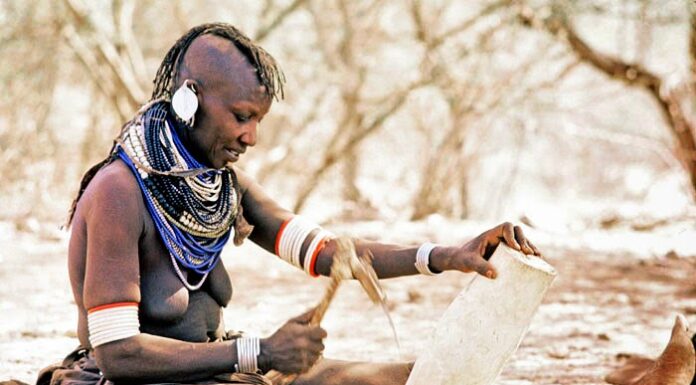

13 artisans travelled to Nairobi to showcase their products at Bizarre Bazaar Global Village, one of Kenya’s largest open-air markets for art, fashion and design. The artisans, from both refugee and host communities in Turkana, made 102,000 Kenyan shillings in sales over just two days.

‘It was more than just a market – it...

News

Polygon launches first programmatic Digital Out-Of-Home (DOOH) campaign in Kenya for Jaguar Land Rover

Staff Writer -

Polygon (https://PDOOH.co.za/), Africa’s leading and largest programmatic aggregated digital out-of-home (DOOH) publisher network has launched its first programmatic DOOH (pDOOH) campaign in Kenya for luxury automotive brand Jaguar Land Rover (JLR).

The campaign, executed in partnership with Polygon’s technology provider Place Exchange and media agency Omnicom Media Group (OMG), celebrates JLR’s 55-year anniversary and...

The damage caused by payroll fraud and ghost employees is often catastrophic: large sums lost and additional spending in investigations and prosecutions. In many cases, the companies forgo legal actions and fire the fraudster, who often moves to a new business and restarts their crimes.

"Most companies unfortunately only uncover payroll fraud by accident....

News

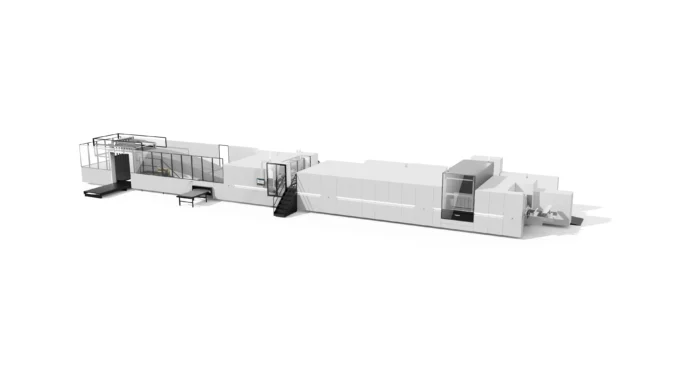

Canon Announces the corrPRESS iB17, a New Digital Press for Industrial-Scale Corrugated Packaging Printing

Staff Writer -

In line with its intention to become a leading force in digital labels and packaging production, Canon (www.Canon-CNA.com) is today using its participation in the FEFCO (European Federation of Corrugated Board Manufacturers) Technical Seminar 2025 (Rome, 8th – 10th October) to announce the Canon corrPRESS iB17, a next-generation inkjet press engineered for industrial-scale corrugated packaging production. Capable of digitally...

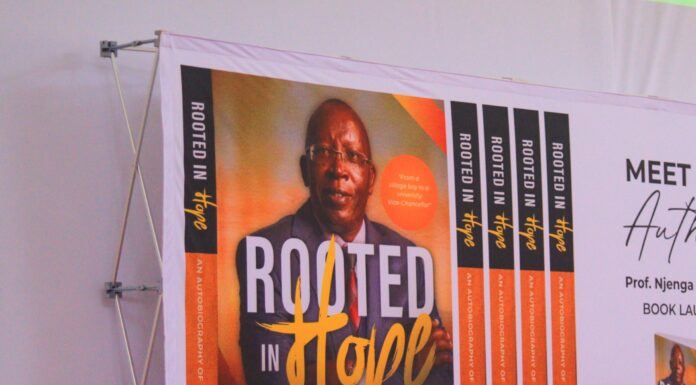

Zetech University Vice Chancellor Prof Njenga Munene recently launched his Autobiography named 'Rooted in Hope' at the serene Mang'u Technology Park.

In a glitzy event that featured Kenya's brightest minds, Prof Munene shares his journey of life, from a village boy in an unknown school in rural Kenya to a university don and a...

By Vincent Munga

State Department for Correctional Services has ended its third edition of the Correctional Service Week by awarding institutions and individuals for their exemplary service.

The three-day engagement, themed “Efficient Service Delivery for the Common Good,” reflected on progress, innovations, and challenges in promoting justice, rehabilitation, and public safety...

Kenya Airways has operated a first flight to Cape Town, South Africa, using a 50 percent blend of Sustainable Aviation Fuel (SAF).

The flight, KQ784, departed from Nairobi on Sunday and makes it a first-of-its-kind in Africa.

“From upcycled blanket bags and recyclable and reusable cutlery to...