Home Blog

Network International (Network), a leading enabler of digital commerce across the Middle East and Africa (MEA) region, has launched innovative in-person payment solutions in Kenya, as part of its plans to transform payment across Africa.

“Launching our point-of-sale solutions is part of our strategy to enter the in-person payments market in Kenya. As a...

News

Polygon launches first programmatic Digital Out-Of-Home (DOOH) campaign in Kenya for Jaguar Land Rover

Staff Writer -

Polygon (https://PDOOH.co.za/), Africa’s leading and largest programmatic aggregated digital out-of-home (DOOH) publisher network has launched its first programmatic DOOH (pDOOH) campaign in Kenya for luxury automotive brand Jaguar Land Rover (JLR).

The campaign, executed in partnership with Polygon’s technology provider Place Exchange and media agency Omnicom Media Group (OMG), celebrates JLR’s 55-year anniversary and...

The damage caused by payroll fraud and ghost employees is often catastrophic: large sums lost and additional spending in investigations and prosecutions. In many cases, the companies forgo legal actions and fire the fraudster, who often moves to a new business and restarts their crimes.

"Most companies unfortunately only uncover payroll fraud by accident....

News

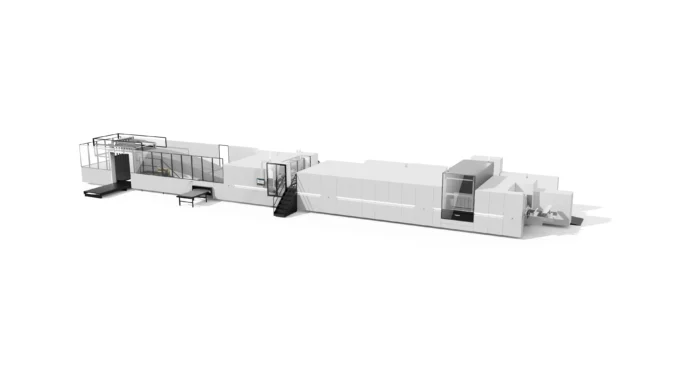

Canon Announces the corrPRESS iB17, a New Digital Press for Industrial-Scale Corrugated Packaging Printing

Staff Writer -

In line with its intention to become a leading force in digital labels and packaging production, Canon (www.Canon-CNA.com) is today using its participation in the FEFCO (European Federation of Corrugated Board Manufacturers) Technical Seminar 2025 (Rome, 8th – 10th October) to announce the Canon corrPRESS iB17, a next-generation inkjet press engineered for industrial-scale corrugated packaging production. Capable of digitally...

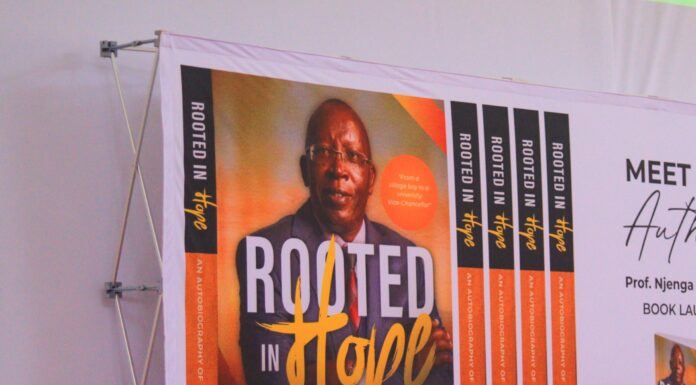

Zetech University Vice Chancellor Prof Njenga Munene recently launched his Autobiography named 'Rooted in Hope' at the serene Mang'u Technology Park.

In a glitzy event that featured Kenya's brightest minds, Prof Munene shares his journey of life, from a village boy in an unknown school in rural Kenya to a university don and a...

By Vincent Munga

State Department for Correctional Services has ended its third edition of the Correctional Service Week by awarding institutions and individuals for their exemplary service.

The three-day engagement, themed “Efficient Service Delivery for the Common Good,” reflected on progress, innovations, and challenges in promoting justice, rehabilitation, and public safety...

Kenya Airways has operated a first flight to Cape Town, South Africa, using a 50 percent blend of Sustainable Aviation Fuel (SAF).

The flight, KQ784, departed from Nairobi on Sunday and makes it a first-of-its-kind in Africa.

“From upcycled blanket bags and recyclable and reusable cutlery to...

Insurance and reinsurance firms operating in Kenya could soon pay higher licensing and annual fees under new proposals by the Insurance Regulatory Authority (IRA).

According to the draft Insurance Regulations 2025, the IRA plans to raise insurers’ licensing fees to Sh500,000 from the current Sh150,000, while reinsurers’ fees will rise...

Canon Central & North Africa (CCNA) (www.Canon-CNA.com), a leading provider of imaging solutions, successfully hosted its annual Dealer Conference at Conrad Hotel, Dubai. Themed “ICE: Innovation, Customer, and Experience,” this year’s edition carried special significance as CCNA celebrated its 10-year anniversary. The exclusive event brought together 100 partners from across Africa to explore Canon’s strategic direction, celebrate...

Sanlam Investments (www.SanlamInvestments.com) has confirmed its third sponsorship of Africa’s Green Economy Summit (AGES), taking place in February 2026, reaffirming its commitment to financing Africa’s sustainable future through innovation in renewable energy, water security, waste reduction, ocean and climate finance.

Since its inception in 2023, AGES has become a key platform for connecting global...

Recent Kaspersky (www.Kaspersky.co.za) research entitled “Cybersecurity in the workplace: Employee knowledge and behaviour” has found that 81,7% of professionals surveyed in the Middle East, Turkiye and Africa (META) region say that they utilise Artificial Intelligence (AI) tools for work tasks. However, only 38% have received training on the cybersecurity aspects of using neural networks, which is one...